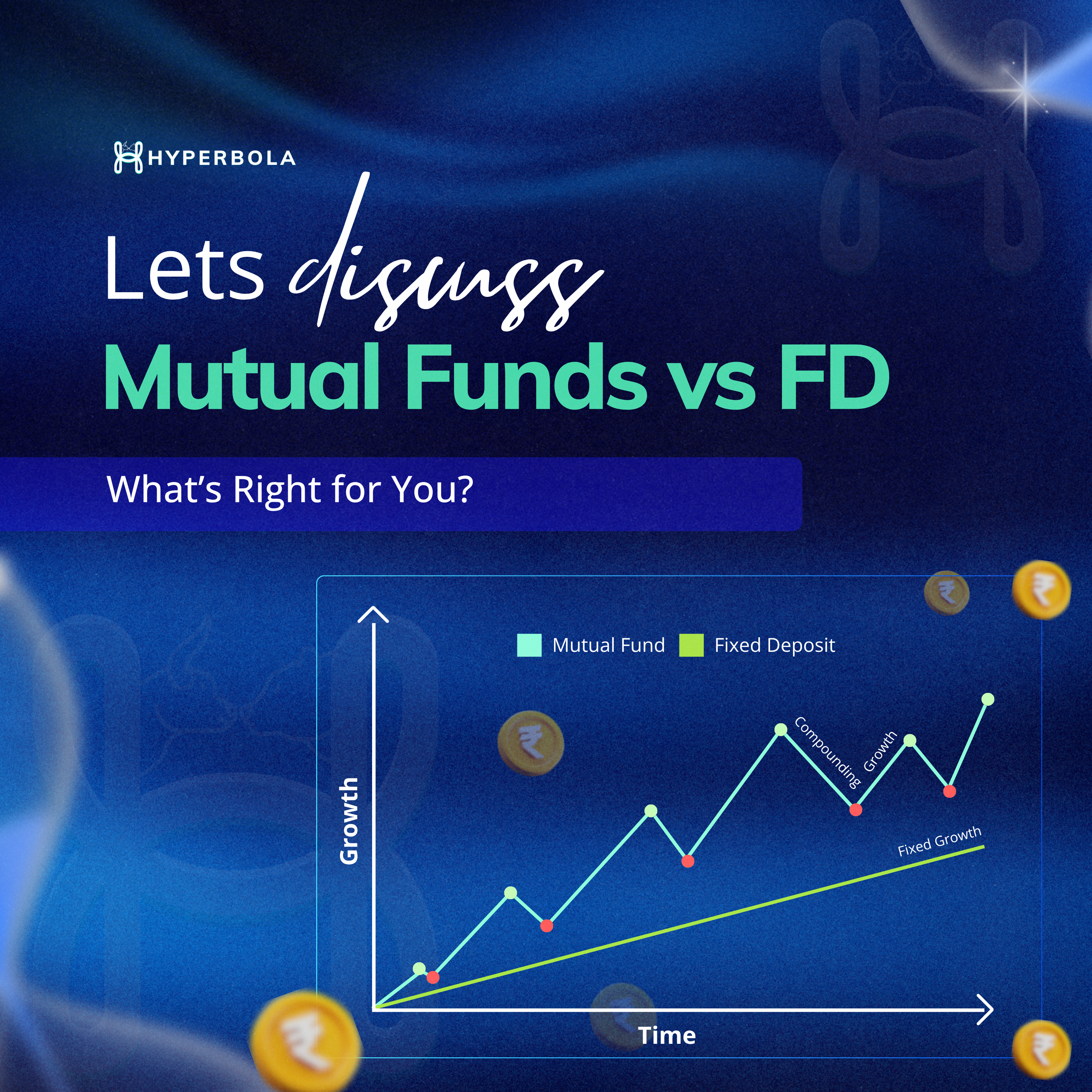

When it comes to investing, most of us look for a mix of safety, growth, and peace of mind. For years, Fixed Deposits (FDs) have been the go-to option for anyone wanting secure and predictable returns.

But with rising financial awareness and increasing market participation, Mutual Funds are steadily gaining popularity — offering flexibility, potential for higher returns, and products tailored to every kind of investor.

If you’re weighing your options between the two — mutual funds or fixed deposit — this blog will guide you through the essentials, differences, and decision points, so you can figure out what suits your needs best.

Why it matters – The shift in investment preferences

In a world where inflation constantly eats into the value of your savings, just letting your money sit idle in a savings account may no longer cut it. While FDs are trusted for their safety, many investors are now looking at mutual funds for long-term growth, tax efficiency, and customisable risk levels.

So when people ask: “Fixed deposit or mutual fund, which is better?” — the answer is more nuanced than just risk and return.

It depends on your financial goals, time horizon, and the kind of investor you are.

Let’s break it all down in simple terms.

Understanding the basics – What is a fixed deposit? What is a mutual fund?

Before we compare them, let’s understand what they are.

Fixed Deposit (FD)

A Fixed Deposit is a financial instrument offered by banks and NBFCs where you invest a lump sum for a fixed tenure and earn a predetermined interest rate. It’s one of the most low-risk investment options and ideal for people who don’t want any surprises.

Example: If you invest ₹1 lakh in a bank FD at 7% interest for 5 years, you’ll get around ₹1.4 lakhs at maturity — simple, predictable, and guaranteed by the bank.

FDs are regulated by the Reserve Bank of India (RBI), and deposits up to ₹5 lakhs per bank per individual are insured under DICGC (Deposit Insurance and Credit Guarantee Corporation).

Mutual Fund

A Mutual Fund pools money from many investors and invests it across asset classes — like equities (stocks), debt (bonds), or a combination of both.

These funds are managed by professional fund managers. Returns are market-linked, meaning they depend on how the underlying assets perform.

Example: Say you invest ₹1 lakh in an equity mutual fund that gives an average annual return of 12% over 5 years — you’ll earn around ₹1.76 lakhs, which is significantly higher than an FD. But there’s also the possibility of short-term volatility.

Mutual Funds are regulated by SEBI (Securities and Exchange Board of India) and distributed through AMFI-registered platforms like Hyperbola, ensuring transparency and investor protection.

Mutual Funds vs FD – Key differences you should know

Let’s break it down category-wise for a comprehensive overview:

| Factor | Fixed Deposit | Mutual Fund |

| Returns | Fixed, predetermined (around 6–7% p.a.) | Market-linked; varies by fund type (6%–15% or more) |

| Risk | Very low; capital protected | Varies – low (debt funds) to high (equity funds) |

| Liquidity | Low – premature withdrawal may attract penalty | High – can redeem anytime (except ELSS or lock-in funds) |

| Taxation | Interest added to income and taxed as per slab | Capital gains taxed; indexation benefits in debt funds |

| Insurance/Regulatory Safety | ₹5 lakh DICGC insurance; RBI regulated | No capital guarantee; regulated by SEBI |

| Investment Horizon | Short to medium term | Suitable for short, medium, and long-term |

| Types Available | One standard type with tenure flexibility | Multiple types (equity, debt, hybrid, sectoral, etc.) |

| Customisation | Limited | Highly customisable based on risk and goal |

| Inflation Beating? | No, returns often < inflation | Yes, especially equity funds in long run |

So, is Mutual Fund better than Fixed Deposit?

From a long-term wealth creation perspective — yes, mutual funds generally offer more potential. However, they come with certain conditions and suitability factors.

Let’s dive deeper into why many investors are making the switch:

Why Mutual Funds offer more for the Long-Term Investor.

Mutual funds are designed to offer flexibility, diversification, and inflation-beating returns — something FDs struggle with beyond short-term needs.

1. Power of Compounding at Higher Rates.

FDs may compound at 6–7% annually, while long-term equity mutual funds can generate 10–14% (historically). Over a 10–15 year period, this difference becomes massive.

Example:

₹5 lakh in an FD for 10 years at 7% = ₹9.8 lakh

₹5 lakh in a mutual fund at 12% = ₹15.5 lakh

That’s a ₹5.7 lakh difference — without doing anything extra.

2. Tax-Efficiency.

FD interest is added to your income and taxed at your slab rate. Mutual fund capital gains have different rules:

- Equity Funds: No tax if gains < ₹1 lakh/year. Beyond that, taxed at 10%.

- Debt Funds: Gains over 3 years get indexation benefits (adjusting for inflation), significantly reducing tax.

3. Investment Flexibility.

With mutual funds, you can:

- Invest via SIP (monthly)

- Start with just ₹500

- Choose from growth or income-oriented funds

FDs require a lump sum, usually don’t allow mid-way top-ups, and come with lock-ins.

Debt mutual funds vs FD: For the conservative investor.

If you prefer low risk but want better returns and tax efficiency, debt mutual funds could be an excellent middle ground between FDs and equity mutual funds.

Why debt mutual funds are worth exploring:

- Invest in government securities, corporate bonds, and money market instruments

- Returns are market-linked but generally stable (6–9%)

- Better post-tax returns than FDs if held for 3+ years

- Offer higher liquidity and more transparency

Example:

A 3-year investment in a high-quality short-duration debt fund may offer ~7.5% CAGR, and due to indexation, your tax liability could be much lower than the FD interest taxed as income.

Benefits of investing in FDs and Mutual Funds.

A well-balanced portfolio often uses a mix of Fixed Deposits (FDs) and Mutual Funds. These two instruments cater to different financial needs — one offers stability, while the other provides growth potential.

Let’s explore the specific advantages of each, so you can see how they complement each other.

Fixed Deposit (FD) Benefits.

Fixed Deposits are one of the most trusted and widely used investment tools in India, especially among conservative savers. Here’s why:

1. Guaranteed returns

FDs offer a fixed, pre-declared interest rate that does not change throughout the tenure of the investment. This certainty gives you clarity on how much you’ll earn at the end.

For example, if you invest ₹1 lakh in a 5-year FD offering 7%, you know you’ll get around ₹1.4 lakh upon maturity — no surprises, no fluctuations.

2. No market risk

Unlike market-linked products like stocks or mutual funds, FDs are unaffected by market ups and downs. Your principal and interest are protected, regardless of market conditions or economic swings.

This makes FDs suitable for risk-averse individuals or those nearing retirement who cannot afford volatility.

3. Ideal for emergency funds or short-term needs

FDs are a good fit for money that you might need in the near future — say in 6 months to 2 years — for things like medical expenses, school fees, or travel. You can choose short-tenure FDs or break them early (with minimal penalty) when liquidity is essential.

4. Works well for capital protection

The primary strength of an FD lies in preserving your capital. You get back your full investment (plus interest), and in banks, it’s further secured by DICGC insurance up to ₹5 lakh per depositor per bank.

This assurance of safety and return makes it a preferred option for conservative investors, retirees, or anyone building an emergency corpus.

Mutual Fund Benefits.

Mutual funds are market-linked investment vehicles managed by professionals, and they offer far more flexibility and return potential than traditional instruments — especially when used for medium- to long-term goals.

1. Potential for higher long-term returns

Mutual funds, especially equity and hybrid funds, offer compounding growth over time. Historical data shows that equity mutual funds can generate 8–14% returns annually over the long term — often outperforming FDs, even after taxes.

A ₹5,000 monthly SIP in an equity mutual fund averaging 12% returns can grow to ₹35 lakh in 20 years.

In comparison, the same in a 7% FD would grow to only around ₹26 lakh.

2. Flexible investment options (SIP, Lump Sum)

You can start investing in mutual funds with just ₹500 per month via SIPs (Systematic Investment Plans) or make one-time lump-sum investments. This flexibility allows you to tailor your investments based on cash flow, financial goals, or market opportunities.

SIPs also allow rupee cost averaging, reducing the risk of market volatility in the long run.

3. Tax-Efficient growth

Mutual funds are structured to help you grow your wealth more efficiently from a taxation perspective:

- Equity Mutual Funds: Long-term capital gains (LTCG) up to ₹1 lakh per year are tax-free. Beyond that, they’re taxed at just 10% without indexation.

- Debt Mutual Funds: LTCG taxed at slab rate (post-2023), but some categories may still offer better post-tax returns than FDs depending on your income bracket.

Compare this with FDs, where interest is fully taxed at your income slab rate — reducing the real returns, especially for those in higher tax brackets.

4. Wide choice across risk categories

Whether you’re a conservative investor or an aggressive one, there’s a mutual fund to suit your profile:

- Low-risk: Liquid funds, ultra-short-term debt funds

- Moderate-risk: Hybrid and balanced advantage funds

- High-risk: Equity and sectoral funds

This range allows you to customize your risk exposure based on your age, goals, and investment horizon — something FDs can’t offer.

Safety: Which one is Safer?

Safety means different things depending on what you’re trying to protect — your capital, your returns, or your peace of mind.

Let’s break it down:

Safety of fixed deposits.

- FDs are considered low-risk and ideal for preserving capital.

- They’re protected under DICGC insurance up to ₹5 lakh per bank.

- Suitable for conservative investors who cannot tolerate market volatility.

Safety of Mutual Funds.

- Mutual funds are regulated by SEBI, and every fund is required to disclose its holdings, expense ratio, and risk level.

- While mutual funds carry market risk, debt mutual funds (especially liquid and ultra-short funds) are relatively stable and used even by corporates for short-term treasury management.

- Funds are managed by experienced professionals, and diversification lowers the risk of any single asset dragging the entire investment down.

In short, FDs offer safety of capital. Mutual funds offer safety through diversification and regulation — but returns are not guaranteed.

So, Mutual Funds or Fixed Deposit — Which is better for you?

It comes down to your goals, risk appetite, and timeline.

- If you want guaranteed returns for a short duration and don’t mind low post-tax gains — FDs are a reliable choice.

- If you’re saving for long-term goals like retirement, buying a house, or building wealth — and are okay with short-term ups and downs — Mutual Funds (especially via SIPs) are likely to reward you better.

- If you’re risk-averse but still want better returns than FDs — consider exploring debt mutual funds or hybrid funds.

The good news? You don’t have to choose just one. Many smart investors create a portfolio mix of both — using FDs for emergency reserves and mutual funds for long-term wealth.

Conclusion

Choosing between mutual funds vs FD isn’t about picking a winner — it’s about finding what aligns with your financial roadmap. What’s important is that you start early, stay consistent, and invest based on your goals and risk profile.

However, always seek professional advice before deciding the best for yourself.

Hyperbola is an AMFI-regulated Mutual Fund Distributor, assisting its investors in making risk profile–based decisions.

Sign up on Hyperbola to better assess your risk profile and start investing in mutual funds.